TaxAct Deluxe 2022 review: More value for your dollar

Our Verdict

A clean interface with attractive pricing and optional help from tax pros makes TaxAct a stiff alternative to meliorate-known programs--especially for cocky-employed filers.

For

- Elegant, unproblematic design

- Articulate language that serves newbies and experienced tax filers alike

- Covers wider array of tax situations than most services

- Now has tax pro help selection

Against

- No style for a tax adept to review your return

- State returns not included in cost

Tom's Guide Verdict

A make clean interface with attractive pricing and optional aid from tax pros makes TaxAct a strong culling to better-known programs--peculiarly for self-employed filers.

Pros

- +

Elegant, simple pattern

- +

Clear linguistic communication that serves newbies and experienced tax filers alike

- +

Covers wider assortment of tax situations than most services

- +

Now has taxation pro assist choice

Cons

- -

No fashion for a revenue enhancement expert to review your return

- -

State returns not included in price

TaxAct Deluxe 2020 has always been in the mix for best tax software, simply perpetually merely backside the behemoths in the industry, TurboTax and H&R Block. Withal, the introduction of new features and services let TaxAct compete more than directly with the top competition.

TaxAct is the most comprehensive service we've seen, with both spider web- and download-based options to cover a wide swath of taxation-filing situations non directly addressed by either TurboTax or H&R Cake. For example, it offers solutions tax-exempt organizations, trusts and estates, and multiple business concern options (sole proprietor, partnership, C-Corporation and Southward-Corporation). TaxAct even has bundles for individual and business organization tax filing, with pricing that encompasses both situations plus the relevant state tax filing. It also remains the best tax software for businesses or cocky-employed.

TaxAct caters well to those who know what forms they need for their taxes, as information technology clearly delineates which forms are included with which product. But the company now provides better guidance on which parcel is advisable for your tax needs. And it does so at reasonable prices, and with a flowing, easy-to-use interface.

TaxAct Deluxe 2020 review: Cost

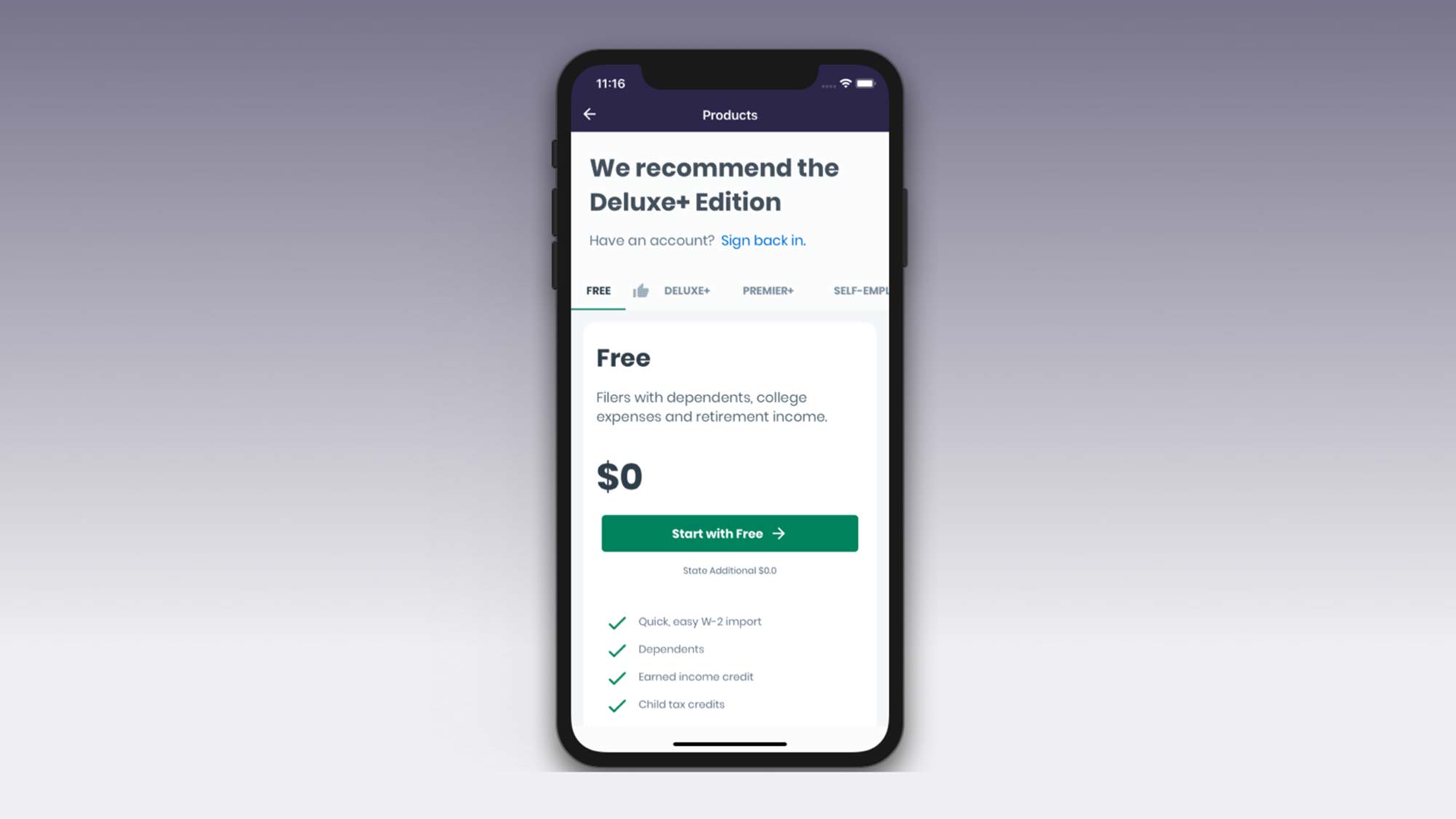

TaxAct has four cadre products in its online Federal portfolio. Prices scale from free to $79.95. You have to pay for state returns separately.

The primary step-ups from TaxAct's complimentary version closely follow the industry standards used by TurboTax and H&R Block, but at lower prices: TaxAct Complimentary, Deluxe ($44.95), Premier ($69.95), TaxAct Self-Employed ($79.95). All four of these options have TaxAct's new Xpert Assistance filing available; adding Xpert Aid bumps those prices to $35, $74.95, $94.95, and $139.95, respectively (state pricing stays the same). All four of the same tiers are likewise available for download ($19.95, $99.95, $109.95, and $119.95, respectively including ane land return).

Furthermore, TaxAct distinguishes itself by having TaxAct Estates & Trusts (Form 1041) ($109.95 online, $159.95 download) for handling filing a return for an manor or trust. And it has TaxAct 2020 Tax-Exempt Organizations ($109.95) for those who run an organization field of study to sections 501(a), 527 and 4947(a)(one).

In addition to these products, TaxAct has another four concern-specific options: built effectually whether you have a Sole Proprietor (Form 1040C, Schedule C) ($64.95), Partnership (Form 1065) ($109.95), a C Corporation (Class 1120) or an S Corporation (Form 1120S). Each of these options has a downloadable version at a premium ($119.95 for the Sole Proprietor, $159.95 for the residuum). TaxAct also offers business organization filers the chance to become bundles that include individual and business forms.

TaxAct Deluxe 2020 review: State filing

Dissimilar most other tax software, TaxAct Deluxe charges extra for state returns. Land tax filing costs $four.95 per state with the gratis TaxAct service. State filing costs $44.95 for about other products, unless you're buying one of the domicile and business organisation bundles or you've downloaded TaxAct. 1 state e-file is included free in those scenarios.

Land filing for some of the specialty packages for businesses, taxation-exempt organizations, and estates and trust is $49.95 for state filing online; $50 for the single-state download, $100 for the all-states download.

TaxAct Palatial 2020 review: Features

As with other tax software, the amount yous spend for TaxAct will decide the full swath of features. For example, the free product includes access to multiple taxation forms, more than than y'all get from rival services, and will handle the stimulus credit and unemployment income. Only TaxAct's free version lacks basic interest income, which comes with TurboTax's free product.

Every bit you lot stride upward through the bachelor tiers, you will add additional revenue enhancement forms; this is where having the expertise to know which forms y'all need helps (view the comparison chart). The Deluxe version adds a litany of boosted forms, including itemized deductions, adoption credits, student loans, and Wellness Savings Business relationship, plus back up for Schedule A itemized existent-manor taxes and mortgage deductions, and Schedule SE self-employment taxes.

The Premier Edition is more targeted towards investors, with support for boosted income streams like stocks, rental property income, K-one income, and foreign financial accounts. The Self-Employed Edition accounts for personalized business deductions, freelance, business organization, and farm income; and provides the TaxAct Deduction Maximizer for helping yous find potential deductions, and year-round revenue enhancement back up for filing quarterly taxes.

TaxAct Deluxe 2020 review: Available assistance

New for 2021 is TaxAct Xpert Aid, an on-demand feature for accessing alive one-on-one support from CPAs, enrolled agents (EAs), and other tax professionals. The concept is similar to TurboTax Live, in that y'all can connect by voice or video, on need or past appointment. You tin can also share the computer screen to make it easier for someone to walk you through the procedure. However, TaxAct does non offering the selection for a professional person to review and/or file a return on your behalf, something that's offered with H&R Cake and TurboTax.

TaxAct provides online back up in the grade of searchable resource on tax terms and guidance for filing your render. There is also "taxpayer support" via non-toll-gratis phone and email for 12 hours a day on weekdays, eight hours on Saturdays and vii hours on Sundays in the lead-up to the April 15 tax-filing deadline. Telephone back up is bachelor ix hours on weekdays thereafter. (A disclaimer on TaxAct's website stresses that information technology will offer technical aid, simply won't requite specific revenue enhancement advice.) This support is to answer questions about the product, but information technology is not designed to provide any revenue enhancement guidance, every bit is available via H&R Cake and TurboTax.

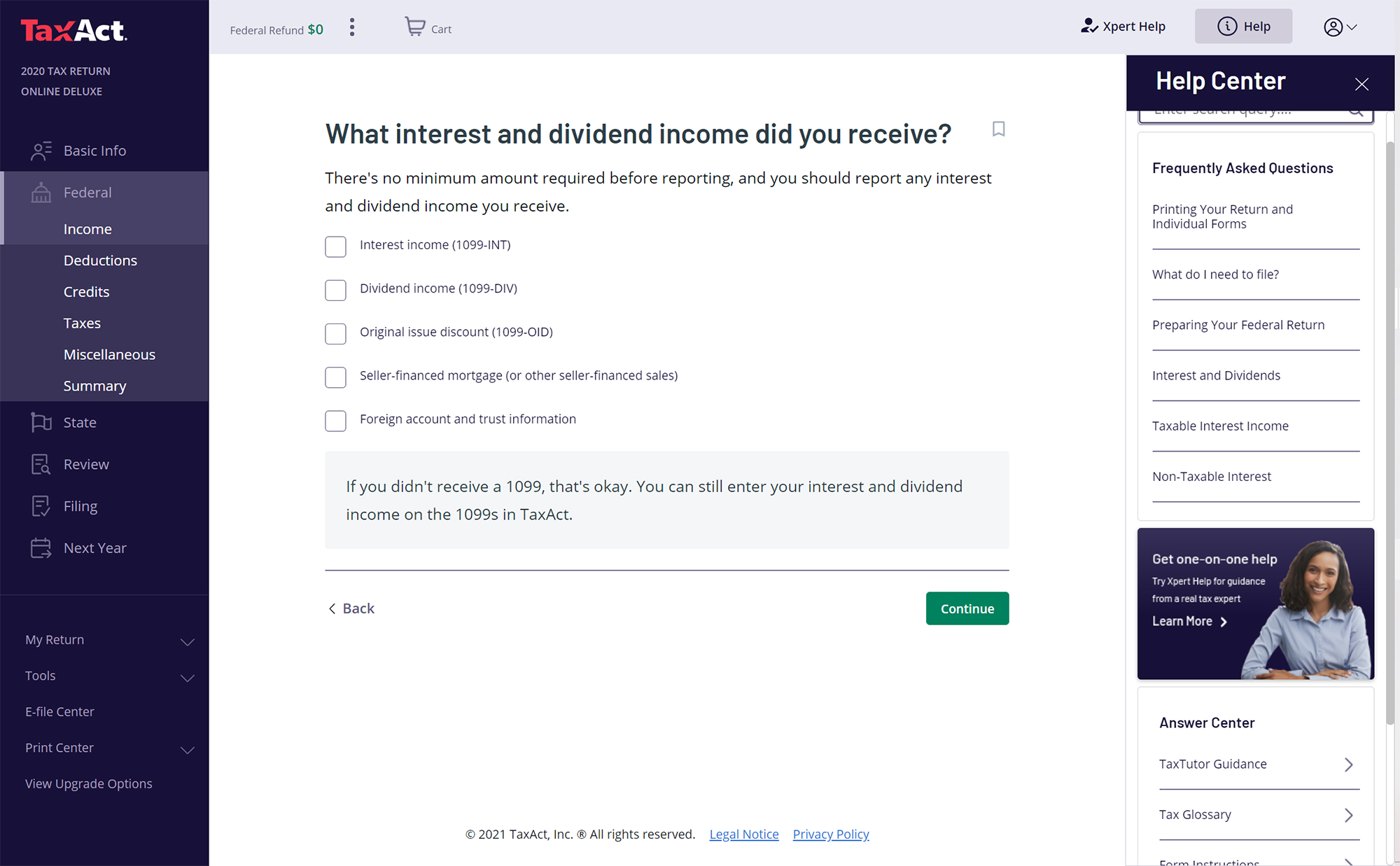

Throughout the spider web interface, you'll have options for guided data entry; pop-up info boxes to explain specific entry points; and a searchable Help Center pane with links to resources and explanations on TaxAct's website (including tax calculators, TaxTutor, and has a convenient checklist of documents to make sure you have everything on hand to practice your return. If you didn't sign up for the Xpert Help option at the start, no trouble: Yous'll be reminded of the option when y'all first ready your return, and option is never far along the top nav bar.

TaxAct Deluxe 2020 review: Ease of use

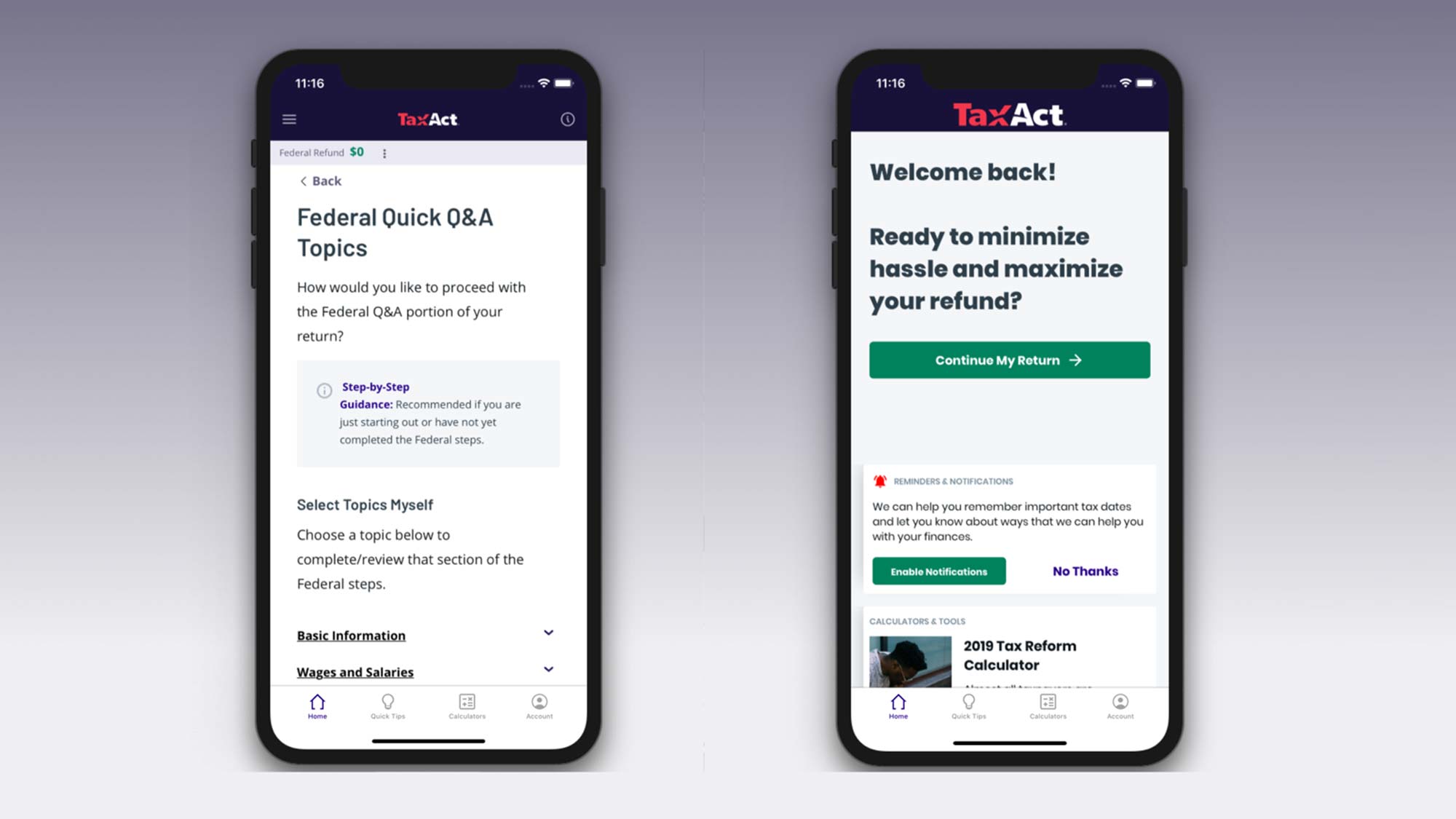

Getting started with TaxAct is like shooting fish in a barrel: Pick a product and sign up by entering your email accost, waiting for an account verification lawmaking to exist sent to you, and choosing your username and password. If yous are a returning customer after a large gap, the service uses both phone and email to transport verification codes.

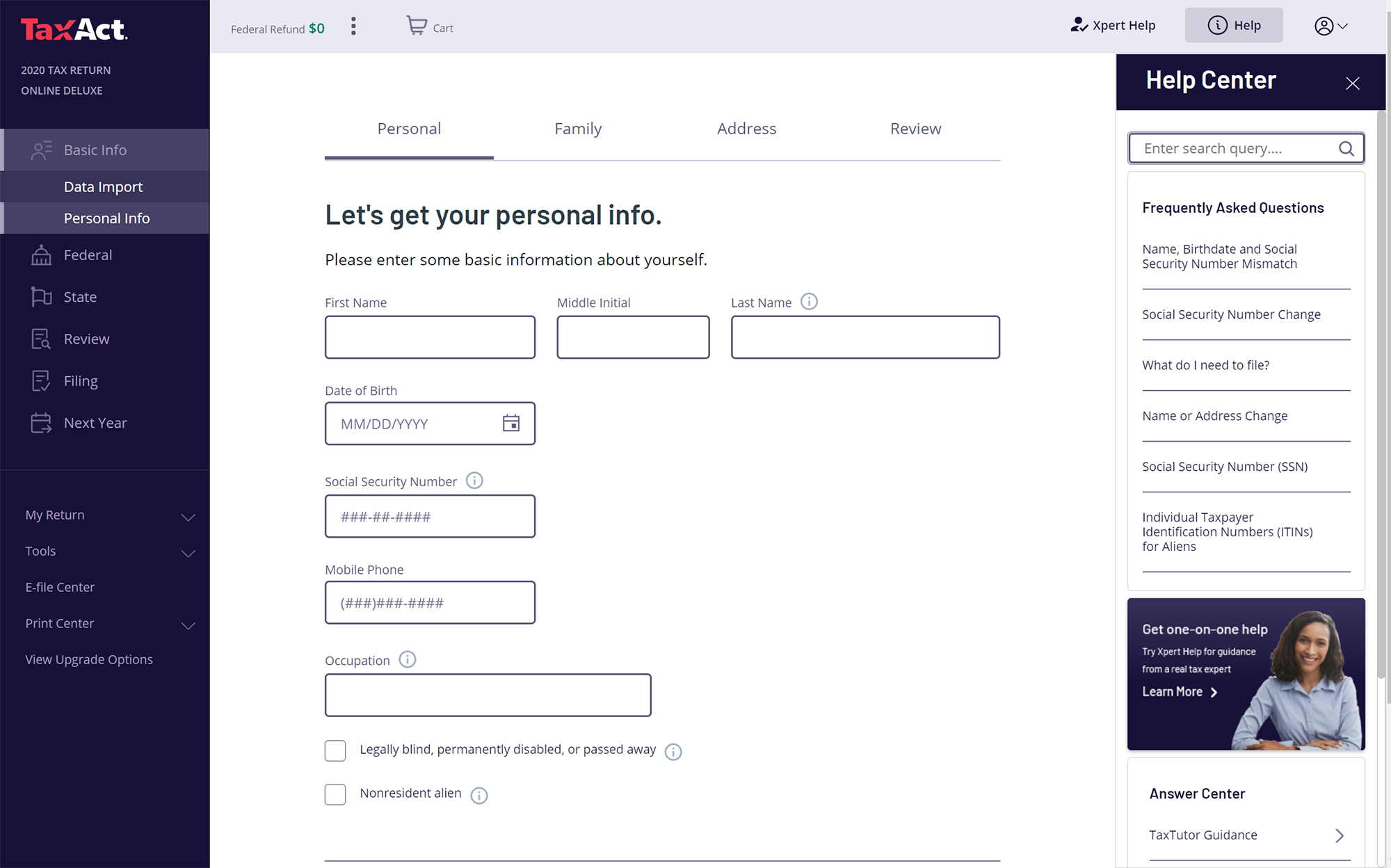

One time we began our 2020 tax render, we were prompted through a series of steps to enter data. We liked TaxAct'southward make clean interface, with articulate and straight language, as opposed to the false friendly language of some competing services. The site is responsive and thoughtfully presented, with a left-hand navigation pane, a right-manus assist pane with search bar, and a cardinal main screen that uses fonts and graphics to make the pages compelling and piece of cake to read. We could easily follow the prescribed order of topics for completing the Federal render, or choose to jump around by picking something different from the left navigation pane. Within each section, tabs along the summit of the screen allow you maneuver amid the options for that department.

You'll outset with inbound basic information about yourself, and so jump into preparing the federal render. TaxAct will prompt to import a PDF of your 2019 render, including support for returns prepared by TurboTax and H&R Block (a step we skipped). Y'all can then enter personal information, relationship status, whether there's a dependent to claim, and your residency address. This section is streamlined at the start, to become correct to the meat of the thing creating your federal render. If you're unsure what something refers to or what to select, simply click on the information icon to the correct of each entry. You lot'll go a pop-up overlay describing what something means.

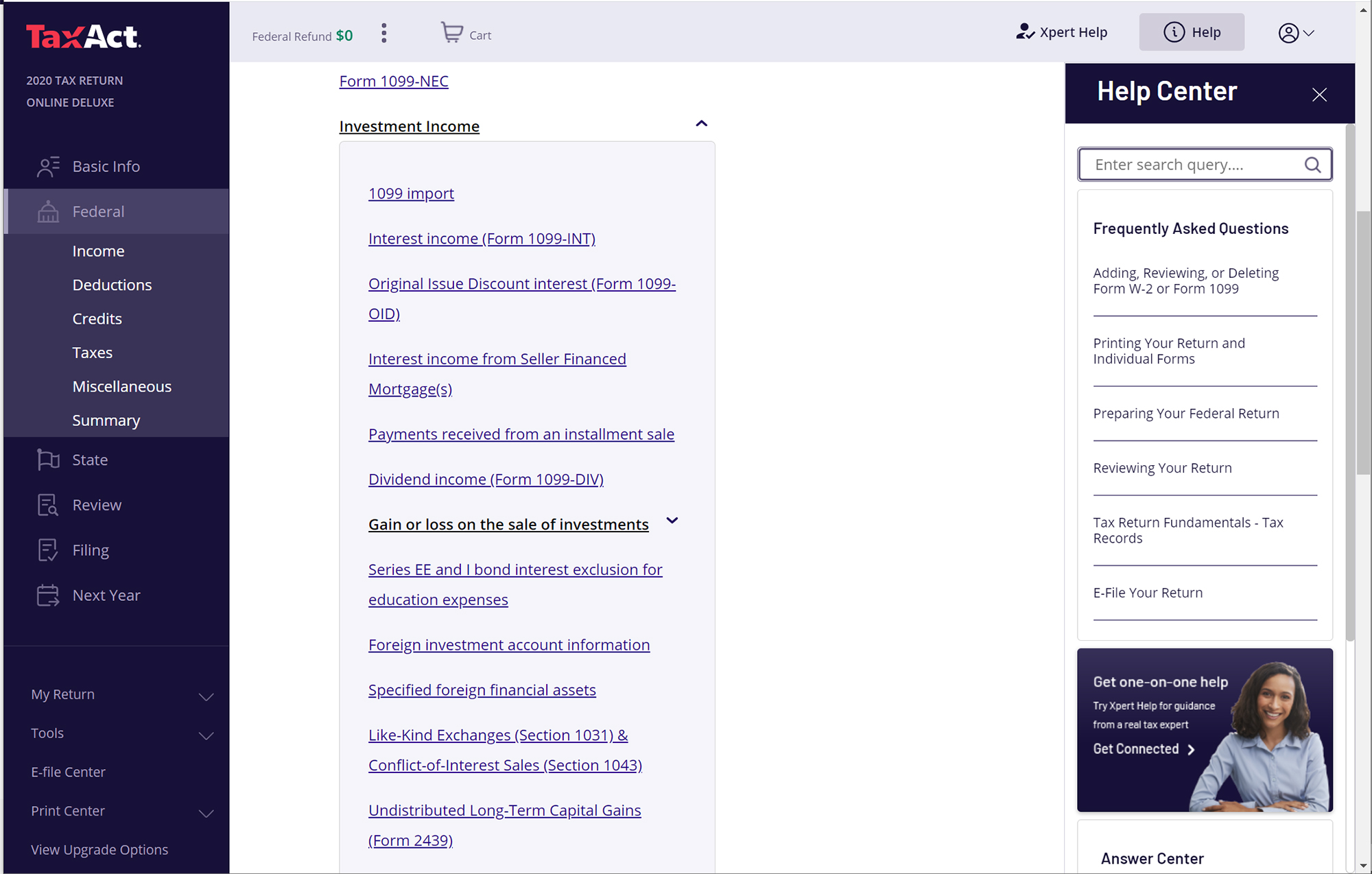

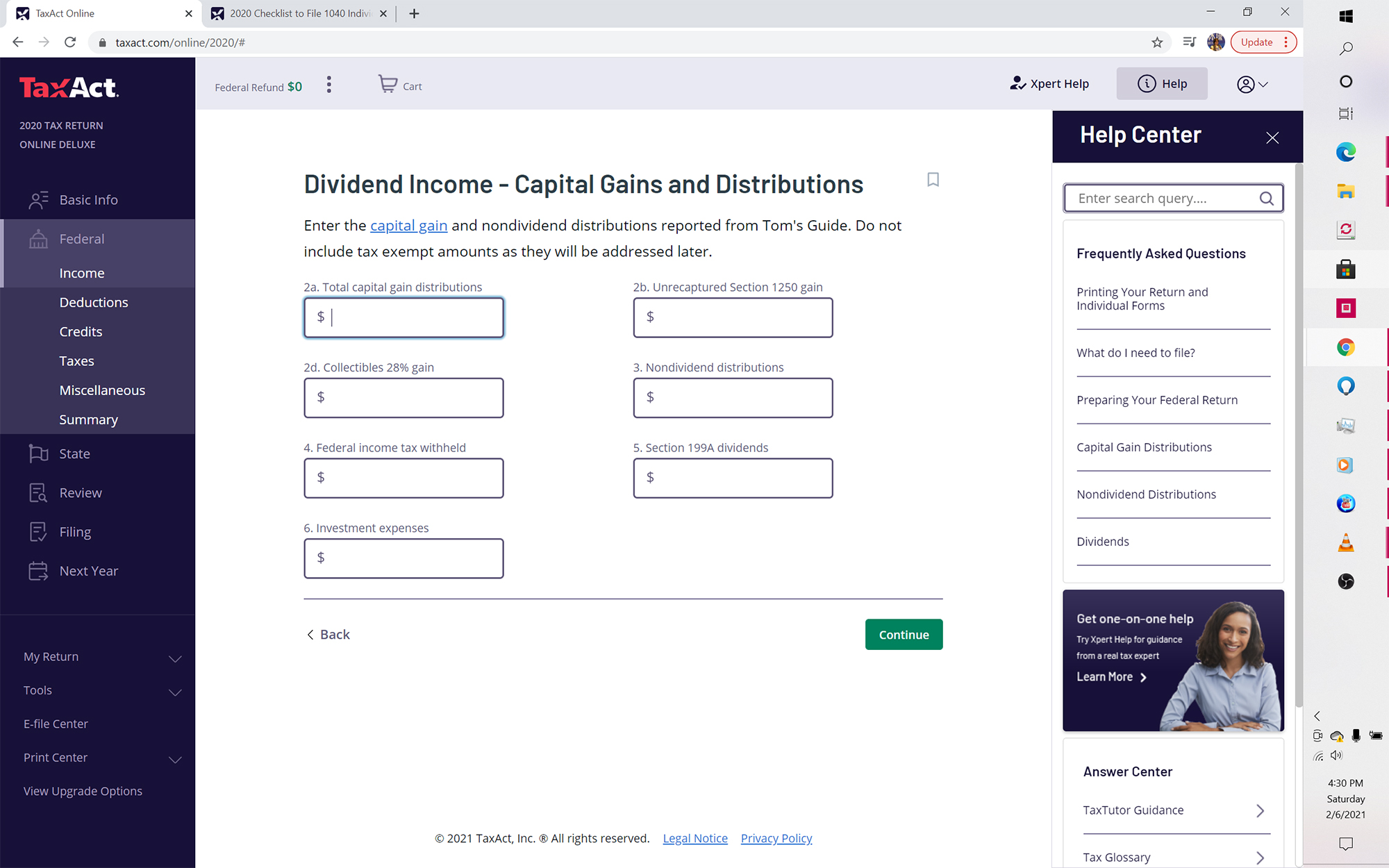

Information entry for the federal return is similarly structured, starting with basic queries about income, investments, family unit expenses, education expenses, and housing. TaxAct uses this info to find savings, simply the company also asks for permission to share your return details with sis company TaxSmart Enquiry LLC to get customized tax tips (you can opt out).

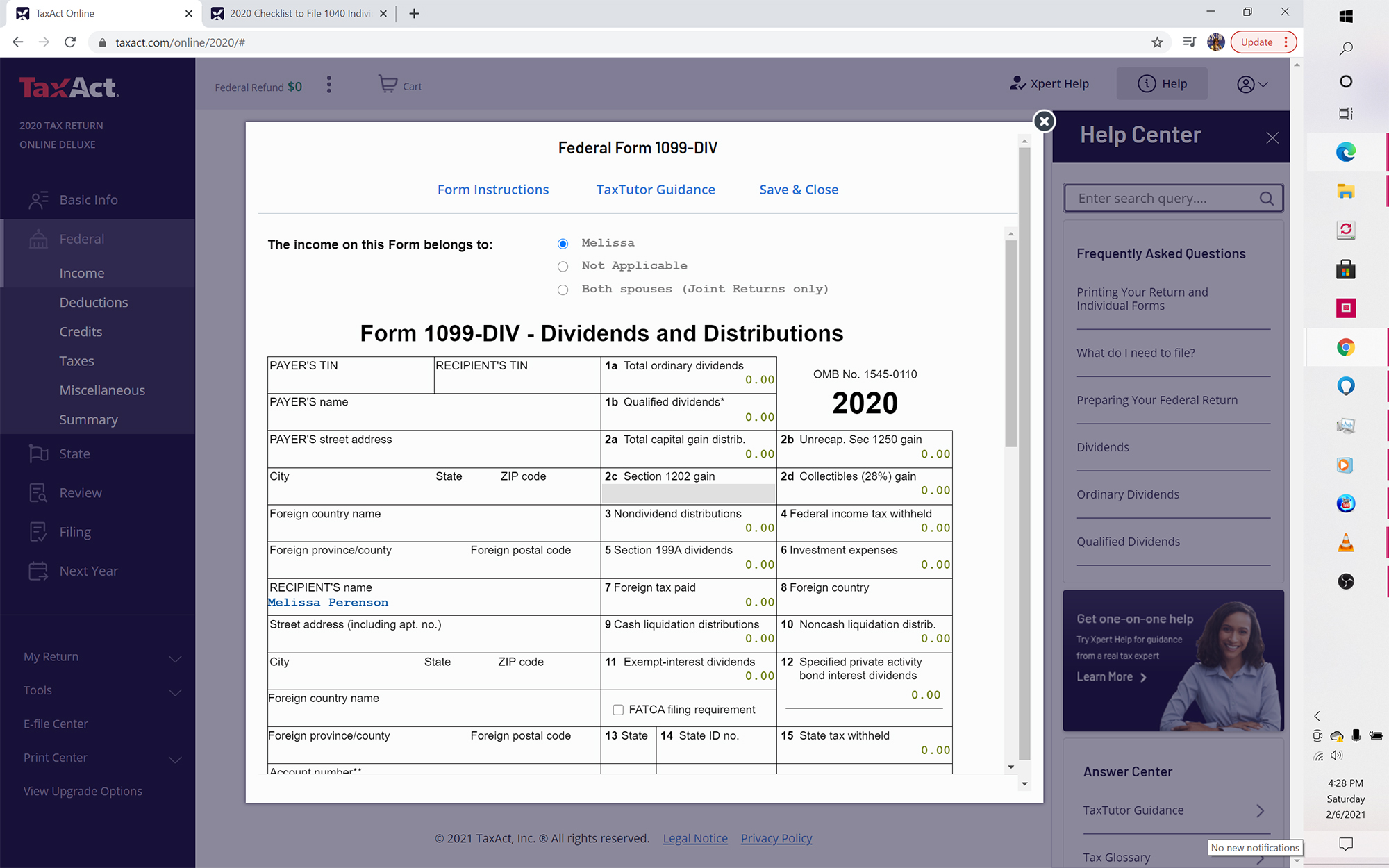

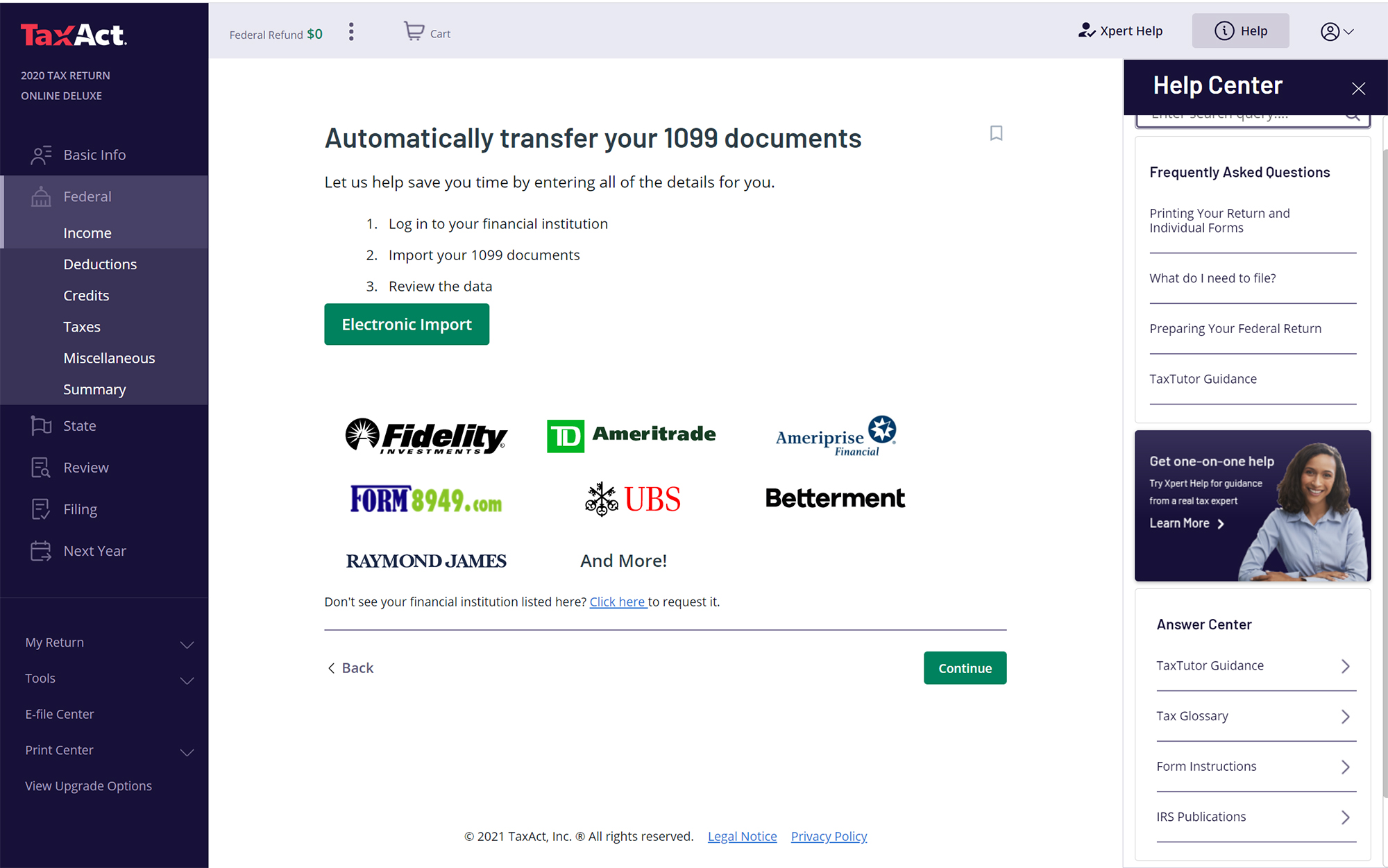

Side by side you'll enter your income data. One time you know what you demand to enter, you have iii methods to do so — an electronic import from ane of the fourteen supported institutions, manual entry (in a perfect digital replica of the 1099-INT form) or using guided fields to input specific data.

Opposite to what TaxAct indicates on its site, the pricing isn't very transparent. When nosotros chose a course non supported by the Deluxe version we tested, TaxAct didn't prompt usa to upgrade; equally recently equally 2018, the service gave a friendly notice to upgrade.

Nosotros could adjacent move through the many fields to fill out via the screen prompts, or navigate via the left navigation pane to move through the process of completing our taxes, navigating each section of the Federal form in sequence, Deductions, Credits, Taxes, Miscellaneous, and and so encounter a summary at the end. Each section was conspicuously presented and business organisation-like in its approach.

TaxAct Deluxe 2020 review: Verdict

With a wide swath of online products, elegant presentation, and the addition of interactive support with live tax professionals, TaxAct Deluxe 2020 impresses beyond the board--whether your tax needs are elementary, or circuitous. But you don't get the option to take a tax professional review your return, which makes H&R Block Deluxe and TurboTax Deluxe better choices if you're unsure or need assistance filing.

As we've noted in previous reviews, we feel TaxAct is the all-time taxation software for someone who knows and understands their taxes and is familiar with revenue enhancement terms and forms, and the clear step-by-step of the interface makes it a pleasure to navigate fifty-fifty if you're not well-versed in taxation lingo. It'southward also the best taxation software if you're looking for the best value, without going with a free product like CreditKarma Taxation. Meanwhile, the addition of Xpert Help makes TaxAct more than accessible than ever.

Source: https://www.tomsguide.com/reviews/taxact-deluxe-2020

Posted by: starrfacesoccat.blogspot.com

0 Response to "TaxAct Deluxe 2022 review: More value for your dollar"

Post a Comment